Mobile applications are powerful technologies, offering us the advantage of performing nearly all our actions on a desktop computer while on the go. Banks and financial institutions are becoming mobile; therefore, if you own one but have yet to embrace mobile apps as part of their strategy, get ready to be hit hard by competitors that have done it first!

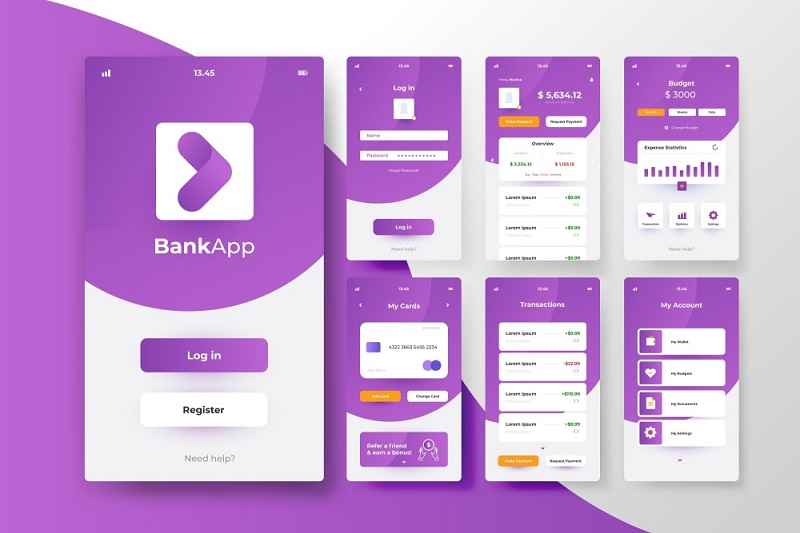

FinTech app solutions can help you build a banking app for your customers. Utilizing mobile banking apps allows customers to do all these activities and more directly from their smartphones – truly convenient! However, as banking apps have become more mainstream among customers and financial institutions, simply having one may no longer suffice. Customers increasingly expect a seamless banking experience through these applications, giving financial institutions an edge against competitors if they can deliver it effectively.

Banks enjoy leading positions in their markets due to a superior, customer-oriented banking app designed by professional designers that meets customers’ needs. Customers love these mobile banking apps because they simplify depositing checks, transferring funds or checking balances. According to Statista, the number of digital banking users in the US is expected to rise to 217 million by 2025!

5 Must-Have Features for a Successful Banking App

Below are several key features that must be quickly and seamlessly implemented into digital banking platforms:

Feature 1: Robust security

Consumers recognize cybersecurity as a top consideration when making online decisions and selecting digital products and services, particularly bank customers who use apps. From their perspective, app security means not having their money stolen by malicious actors.

Banks typically have the greatest control over threats against server and transit layers (communication between the server and mobile device), leaving user and device layers as potentially the most vulnerable spots – especially considering attacks targeting mobile apps take advantage of users’ behaviour to launch attacks on them.

Here are some of the most prevalent threats:

- Phishing or fake banking apps: One analysis found that up to two per cent of the top 1,000 highest-earning apps are scams that have stolen over $US 48 million. These copycat apps mimic official banking platforms to appear legitimate.

- Trojans and Malware: Trojans and malware pose a real risk in the form of malicious code that steals customer data when customers interact with their banking apps, including taking advantage of one-time passwords (OTPs) sent via SMS for authentication purposes.

- Man-in-the-middle attack: In this attack, a malicious actor intercepts communications or data transfers between two parties with the intent to either listen in on them, spy on them or assume one’s identity to create the illusion that there is an uninterrupted flow of information. An attacker could set up free Wi-Fi hotspots to gain access to users’ log-in credentials when accessing any app on their phone.

Notably, users aren’t solely to blame when attacks like this take place; banks bear responsibility for mitigating threats by creating security features and intuitive designs which influence user behavior and reduce potential dangers.

Successful mobile banking apps accomplish this through a combination of security features such as:

- End-to-end encryption

- Password dictionaries/dictionary

- Multi-factor or third-party authentication

- AI-powered behavior analysis

- Continuous authentication.

- SMS, email, and push notifications for real-time alerts

- Customer education and reminders

There has long been debate regarding the trade-offs between user experience (UX) and security. Still, they do not need to be mutually exclusive – banks and financial institutions can design UX and security features to work harmoniously.

Though no perfect app exists (and likely never will), industry best practices exist that can effectively address security risks while giving customers an excellent user experience.

Feature 2: Digital core banking

Bankers understand core banking as the back-end system that processes all banking transactions and generates updates to accounts and financial records. Traditional core banking systems include customer onboarding, deposit management, account-to-account fund transfers, loan processing, cash management systems, ledger systems, reporting tools, analytics & security management – to name a few services traditional core banks offer.

To meet customer expectations today, core banking providers have modified their capabilities into digital core banking tools, emphasizing customer experiences across digital channels.

Digital onboarding also facilitates verifications, and the know-your-customer (KYC) process, authentication processes, and digital identity management can reduce friction during online transactions while protecting user data and privacy.

Traditional core banking systems focused on digitization and integration to increase employee efficiency and gain insight into data. More modern digital core banking tools also provide customers with a seamless and secure customer experience when engaging with the bank’s mobile and web channels.

Established banks usually see digital transformation as high-risk. A report estimated it would take the global banking industry approximately 25 years to replace all legacy systems currently in use, so many digital core banking finance software solutions provide for a “multi-core” approach in which digital core banking solutions integrate with legacy core banking systems to build modern customer-facing platforms with less risk associated with replacing legacy systems.

Feature 3: QR code payments and confirmations

Banks should consider including QR (Quick Response) code payments in their mobile apps to serve better consumers, who may already be familiar with its appearance: two-dimensional patterns of black squares arranged in a grid on a white background. QR codes offer many advantages over barcodes, including being easier to scan from screens than paper and more secure as their data can be encrypted.

QR codes have since found widespread adoption across a range of markets worldwide. 1.5 billion people used QR codes to make payments in 2020 alone; usage skyrocketed during the COVID-19 pandemic. One study predicts that by 2025, up to 30% of smartphone users worldwide may use QR codes for payments worth an estimated US$ 3 trillion.

Digital wallets and other fintech apps already use QR codes as payment channels, making it important that banks enable their customers to utilize QR payments from their mobile apps. QR payments provide less friction in the payment or fund transfer journey than account-to-account transfers or credit card payments.

QR code payments provide instant and micro-payment solutions. Use cases include street vendors, restaurants, micro-businesses, toll booths, parking and fueling stations, charity donations, entry to events, and many others.

Banking apps don’t just use QR codes for payments – they also leverage them as confirmation or receipt tools, with certain mobile banking apps creating QR code confirmations that can be shown upon entry to venues, effectively serving as tickets. Thus, QR code features allow banking apps beyond just payment apps.

Feature 4: Bill payments and personal financial assistant

Making payments and setting aside savings or investments money can be an upsetting experience, yet mobile banking apps should make this experience more enjoyable.

Banking apps must allow automatic payments of recurring bills (e.g. electricity, water, broadband internet service provider subscriptions, insurance premiums and loans) to ease consumers’ minds about paying on time without incurring extra debts. They should also facilitate one-off payments using scan-and-pay features with QR codes; these features prove invaluable for property taxes, fine charges and over-the-counter costs.

Recently introduced innovations to mobile banking have also turned these apps into financial assistants, providing more than account balance and transaction history checking capabilities.

Some banking apps can now assist users in tracking spending, managing monthly budgets and gathering insights to assist customers in making sound financial decisions. Today’s banking apps go beyond making payments; they help clients save for that dream vacation!

Digital banking’s relatively newest offering is automated or smart savings accounts, which allow customers to designate certain direct deposits to savings goals or budgets. Additionally, banks analyze reports and move money around as necessary if they determine that some savings don’t need immediate use by their owner.

Feature 5: Cardless ATM withdrawals

Bank customers using this feature can withdraw funds from an ATM without using physical cards, verifying and authorizing withdrawals with their mobile bank app instead. At ATMs, withdrawal is generally handled via QR code scan or near field communication (NFC), whereby customers tap their smartphone onto an NFC reader at an ATM to withdraw funds.

One advantage of this feature on mobile banking apps is reducing customers’ need to carry their debit cards while making transactions more secure than conventional card-based ATM withdrawals.

First and foremost, cardless withdrawals eliminate the threat of card skimmers. Furthermore, two-step authentication may be required when withdrawing cardless funds – this needs your thief to know your smartphone PIN, your account credentials for your bank app, and an authorization code specifically designated for ATM withdrawals.

Though cardless ATM withdrawals may still not be widely adopted, their number increased by 26% last year due to COVID-19 pandemic-driven consumer preference for less physical contact with public devices like ATMs.

Final Words

Banks have increasingly recognized the advantages of hiring a custom mobile app development services company. By giving these free apps away, banks can establish closer ties with them, enhance customer experiences more personally, increase service offerings, and plan marketing campaigns more effectively, all while building close relationships and strengthening client loyalty.

But with people’s changing requirements comes increased customer care and retention in the banking industry. By doing this, banks ensure more stable and sustainable growth for their business while meeting even the highest customer standards.

Banks use mobile banking apps to attract new clients while maintaining existing relationships but to do this effectively, they must constantly look for FinTech development services capable of updating their digital solutions with the most cutting-edge banking and finance features.